Epic Due Diligence Fails That OSINT Could Have Prevented

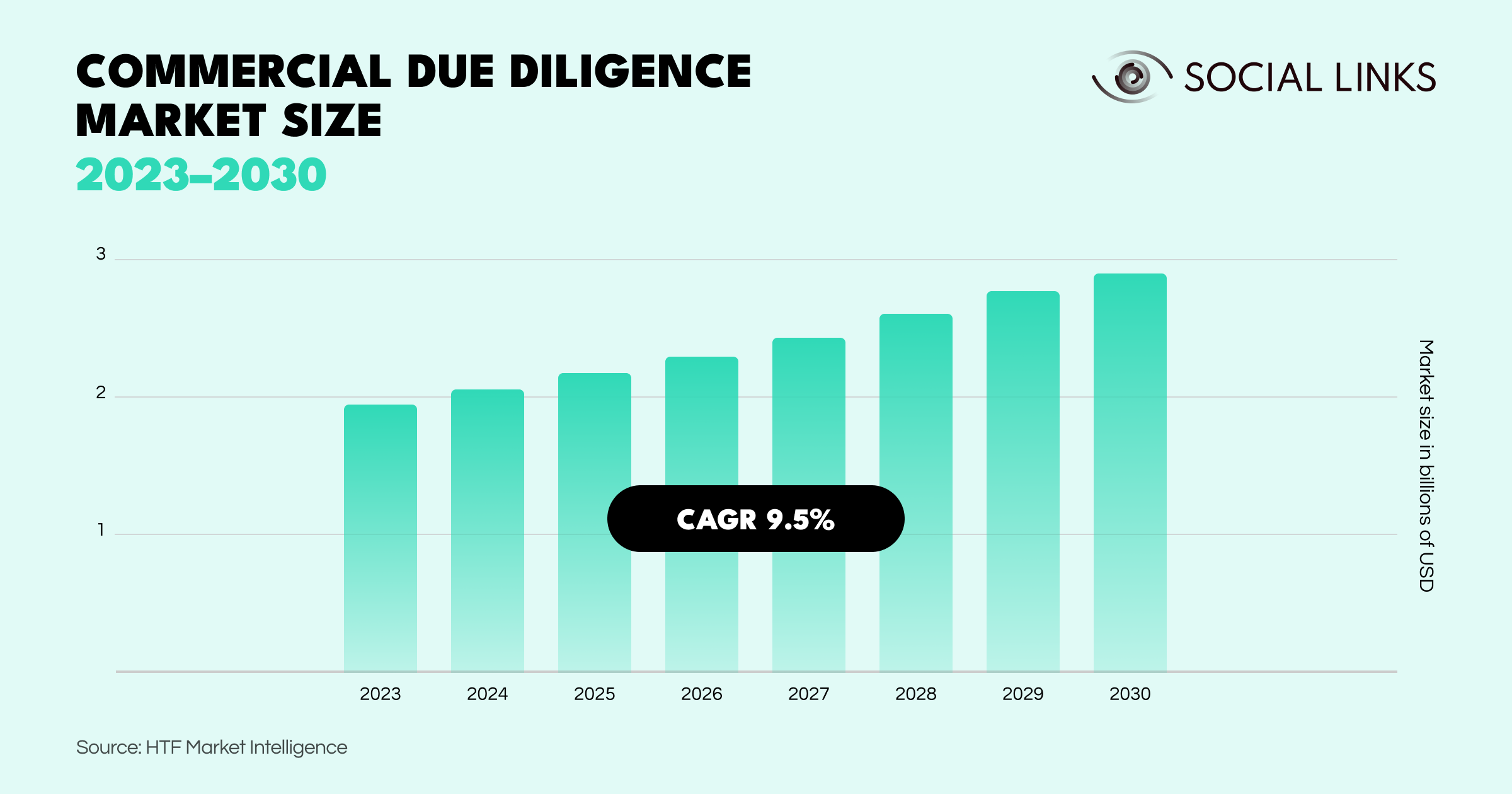

The corporate world is well aware of the manifold risks that M&A and other investment deals can pose. This is reflected in the immense growth of the commercial due diligence market, which currently has an astonishing growth rate of 9.5% and is set to hit a volume of just under $2.8B by 2030.

And yet, for all the costly counterparty investigation, not a year goes by without some jaw-dropping embezzlement outrage hitting the mainstream press. So, in this post, we’re looking at some choice examples of these, how they slipped the due diligence net, and how rigorous OSINT research could have saved investors mind-boggling sums of money.

So here we go—this is our pick of some of the most infamous corporate fraud cases that lost investors billions of dollars, and they illustrate why conducting high-quality due diligence is so important.

Theranos was a health tech start-up led by Elizabeth Holmes that claimed to offer revolutionary blood-testing technology—automated devices that could carry out accurate blood tests extremely quickly and with tiny samples of blood. The product seemed like a genuine breakthrough, attracting immense amounts of investment.

Spurred on by Holmes’ charming speeches and the technology's market potential, venture capitalists and private investors poured $700M into the project, leading to a company valuation of $10B in 2013. However, there was a problem—all of the company’s grand claims turned out to be false.

Given the extent of the deception in the Theranos case, it’s practically inconceivable that a thorough OSINT investigation would not have exposed the numerous falsehoods, from Holmes’ invented biographical stories, to the fact that the company had never actually produced essential components of the promised devices.

In particular, social media investigations could have significantly helped to see through Holmes’ fictions. However, regarding the crazy lack of an actual product, indications would’ve surfaced online through employee social media profiles and activity, and the internal skepticism would’ve been very difficult to contain.

At one point, this huge provider of coworking spaces was valued at an immense $47B. Not unlike the Theranos situation, many investors were won over by the charisma of the then CEO, Adam Neuman, and neglected to give actual business details the scrutiny they deserved.

But the gravy train was derailed when business documentation was finally examined in the run-up to the company’s IPO, unearthing a colorful array of financial violations and irregularities. As a result, the IPO naturally did not go ahead, however the exposure came too late for the many investors who’d been swept along by the project up to then.

Well, for starters, Neuman's numerous extravagances would’ve been impossible to hide from OSINT probing. From the regularly held Wolf-of-Wall Street-style parties to the billionaire-range homes and private jets, a lot of eyebrows and red flags would have ultimately been raised.

SOCMINT research would have found signs of Neuman’s toxic internal despotism (staff were threatened with dismissal if they questioned dictates) and nepotism. Meanwhile, image analysis might’ve caught hints of Neuman’s drug use, and registries show corrupt conflicts of interests, such as CEO property being leased to the company.

You might remember the implosion of this crypto exchange and hedge fund towards the end of 2022. But just to recap, FTX reached its peak in July 2021 as the third-largest cryptocurrency exchange by active trading volume (then at $10B), with over a million users and a valuation of $32B. Then, alarm bells started ringing.

Amid rumors of fishy inter-company client fund transfers and a suspiciously large token deposit with partner firm Alameda Research, Binance announced it would sell its holdings. This led to en masse consumer withdrawals that the exchange—being a Ponzi scheme—couldn’t honor. Co-founder Sam Bankman-Fried was arrested soon thereafter.

Despite the perceived anonymity of cryptocurrency transactions, blockchains consist of open data. With proper blockchain scrutiny and investigation of the intensity of the exchanges, along with the identity and behavior of the beneficiary, analysts could not have failed to raise several red flags.

For example, the huge proportion of the exchange’s assets being held at Alameda Research in FTX’s native FTT token would have been a bright symptom of irregularity. However, by studying the blockchains, the investigation could be widened by tracing political donations and real estate purchases.

On the surface of things, this FinTech startup was a mouth-watering prospect for investors. Promising a mobile banking solution compatible with any device and account, and lucrative returns from fast-growing markets across the global south, Mozido’s valuation quickly ballooned to $5.6B. It was too late for investors when the reality emerged in 2017/18.

Following an SEC investigation, all sorts came crawling out of the woodwork. CEO Michael Liberty and the other tops had been siphoning invested money off to their shell firms instead of developing the product, which, like with Theranos, never actually existed. Meanwhile, staff hadn’t been paid for 5 months, but $48M had been spent on luxury executive parties.

As with the WeWork scandal, diligent SOCMINT and media analysis would’ve found numerous indicators of the wildly lavish lifestyle suddenly enjoyed by the C-level management. Evidence of such unrestrained personal spending would be a pretty clear red flag for investors.

OSINT could also shed light on the connected—and suspicious—shell firms with ambiguous business purposes. SOCMINT techniques could also not have failed to expose the genuine gripes and disaffection of the staff (a sure-fire indicator that all is not well) and enabled the tracking of new hires, dismissals, and executive changes.

A promising medical start-up focusing on gut microbiome analysis, uBiome took off under the leadership of entrepreneur Jessica Richman. The company attracted $110M from prominent funds such as Y Combinator, 8VC, and Andreessen Horowitz, reached a valuation of $600M, and gained much media attention as an innovative company.

The collapse came after a 2019 FBI office raid, which unearthed a variety of fraudulent activity and regulation breaches. These included counter-regulatory marketing techniques, inflated product orders, automatically moving customers to higher tariffs, and an internal culture of fear suppressing the advice of medical experts (also counter-regulation).

OSINT techniques are highly effective at gauging the extent and severity of customer dissatisfaction. Diligent analysis of open data would’ve absolutely discovered a litany of complaints and then been able to look into the specific nature of the grievances and expose the fraudulent activities.

In the medical sphere, expert involvement is taken very seriously, and specialist advice needs to be considered as a matter of regulation. The study of corporate open data would’ve indicated a lack of qualification amongst decision makers, which in turn would’ve shown negligence regarding industry standards.

As extraordinary as these stories are, they should not be viewed as instances of outlying events but cautionary tales of situations that are still very much a real and present danger for investors. No matter what a company's hype, prestige, or legitimacy is, in-depth due diligence that taps into OSINT is crucial to navigating risk.